Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

Morbi Pretium leo et nisl aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque Nec, ullamcorper eu odio.

Jake Clover, CEO of Digital Ascension Group and longtime XRP Advocate, used a new video released on September 3rd to convey a clear message to traders awaiting their final surrender. “I love it either. I don’t think it will happen,” Clover said. “When it was 50 cents, nobody wanted to buy it… I’d buy three years for 50 cents, 30 cents, 40 cents, or I haven’t come back.”

Will XRP never crash 90% again?

Clover eradicates its belief in not a single catalyst but what he describes as a structural change to the market microstructure of XRP. He repeatedly cites the role of Spot Exchange Trade products. Bloomberg’s James Seyfert gives SEC approval at 95% at odds in 2025 – and the execution algorithms used by institutional liquidity providers are in demand as a sustained source of demand that change the negative dynamics of assets. “It’s going to be maintained here for the ETF as they enter the market, and they won’t let that go back,” he said.

Related readings

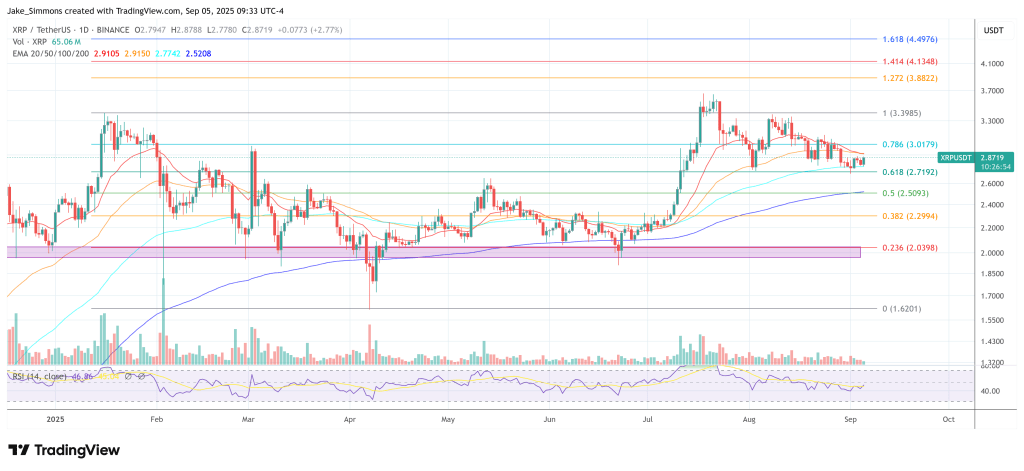

He frames current tapes as a test that the assets have already passed. “When it comes to (crash), there’s a lot of stuff rolled up and it goes down 90% after it goes up. XRP wasn’t doing that,” Clover points out, in contrast to XRP’s behavior and sharp retracements somewhere else in Crypto. In his reading, support has repeatedly argued in crosses with Bitcoin. “We’ve returned to the line here where we had support for Bitcoin and XRP charts, and I think it’s coming from here, especially if Bitcoin continues to rise,” he said.

Clover also links his outlook to a set of suites, a tail of future macros and market structures. He points to the impact of the “reverse carry trade,” the “adoption of stock market back-end payments,” and the impact of ETFs as scenario drivers where the impact of longer term entry prices could make longer term entry prices almost irrelevant on the longer horizon. In one of the video’s most pointed passages, he highlights that view in a dull thought experiment on future price levels.

Related readings

The operational takeaways he offers investors are procedural rather than tactical. Clover makes it clear that market timing is a lost game for almost everyone, and that disciplined accumulation outweighs attempts to catch an accurate bottom. “Averaging the dollar will be the best bet for 99.9% of the time,” he said. “You’re not going to do it when trying to spend time on the market. It’s like 1% of traders who got the market timing better. And it’s going to win on average. You can’t lose it. You can’t lose it.

Risk management cannot be negotiated on his account. He explicitly warns against obligations or leverages that compromise basic obligations to continue. “Don’t use yourself to the point where you can’t use yourself, make bills, or pay anything else,” Clover said, adding that small, regular allocations made solely from excess cash are a good way to express your conviction while surviving the inherent existence of asset class.

If the paper is like that, the meaning of the strategy is, in Clover’s own words, to stop waiting for the ghosts of the old regime. “I know that everyone wants to be able to do things,” he said.

At the time of press, the XRP traded for $2.87.

Featured images created with dall.e, charts on tradingview.com