Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

Morbi Pretium leo et nisl aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque Nec, ullamcorper eu odio.

In a video analysis released today, Crypto Market commentator Cryptoinsightuk claims that XRP is poised to surpass the next leg across Crypto assets, citing liquidity profiles and clear structural diversity in Bitcoin and Ethereum, confirming XRP/BTC Cross signals.

Why XRP can surpass BTC and ETH

At the heart of his case is comparative fluidity mapping via BTC, ETH, and XRP. In Bitcoin, the drawback pool around “about 106k” is said to be a sustained magnet in the daytime window, but the daily heat map still shows heavier clusters on the spot. “Now we’re down at these levels. It’s likely that we’re continuing to receive this liquidity here because of Bitcoin,” he says.

“In the daily time frame, this push to liquidity is beginning to go from about $126,000 to $128,000 and orange liquidity is beginning to go from $141,000,” the analyst added. He frames the reversal quickly and reflexively. “When this move returns to its advantage…it’s pretty aggressive and people will get caught up in the wrong side of the trade.”

Related readings

In contrast, the Ethereum setup is described tactically softly after tapping on significant overhead fluidity during the previous pop. In his hourly mapping, the dense pool sits under the recent decline, implying a slight risk of an average return. “We’ve actually returned to this kind of area. This dense liquidity sits at around $4,050. The dense liquidity sits at around $4,000 to $4,450,” he explains, and can be read to the current US market closures.

The core of bullish divergence lies in XRP. Every hour, he shows that the XRP has already been swept, “taking away the red liquidity below,” leaving “main liquidity… above” and a configuration that encourages an upward reversal if bid momentum appears.

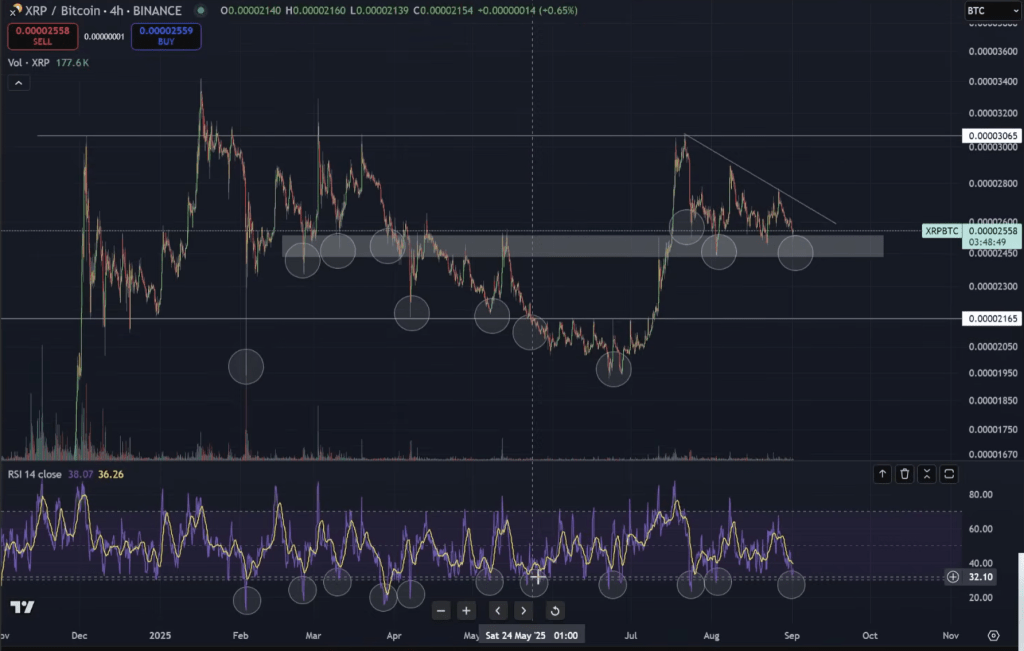

“Is XRP frontrunning here? Will it go to the frontrunning altcoin?” he asks, pointing to the different arrangement of tokens against the liquidity map compared to BTC and ETH. Extending the lens to relative performance, he highlights the XRP/BTC pair on the four-hour chart. Here, the previous resistance box was flipped for support, and the momentum repeatedly became evil in the territory sold in a constructive response.

Related readings

“When we’re at this level, we want to reverse this resistance to support. We’re holding that support right now,” he says. Such overprinting doesn’t call the bottoms completely, but “often they had a decent response, especially when they were in this area of support.”

On a higher time frame, he repeats that the heavier fluidity of XRP is located overhead – if the spot can regain momentum, it is interpreted as a dry powder for continuance, but BTC has an attractive pass to the vacuum upper pool with the downside pocket being quickly cleaned. Ethereum already consumes much of the short-term reverse liquidity, and can tactically slow performance until the lower cluster is tested or readjusted. Analysts link the mosaics to cycle views that remain incomplete.

He emphasizes that the work is descriptive and not normative. “I don’t mean that this is my opinion. I’m just showing the charts here,” he says. Repeat the cycle long paper. He added that the structural differences he outlines in the coming weeks should be clear whether it will translate into XRP leadership on tape as broader market happiness is coming back and chasing traders.

At the time of press, the XRP traded for $2.77.

Featured images created with dall.e, charts on tradingview.com