Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

Morbi Pretium leo et nisl aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque Nec, ullamcorper eu odio.

Capriol founder Charles Edwards claims that Bitcoin’s famous four-year boom-and-bust pattern has effectively ended. This is not because the market has matured to a mild equilibrium, but because the engine that once forced an 80-90% drawdown was dismantled by Bitcoin’s own financial design.

4 years of Bitcoin cycle is dead

In an update #66 newsletter published on August 15, 2025, Edwards added that since half of April 2024, the growth in Bitcoin’s annual supply has fallen to about 0.8%, adding that “less than half of 1.5-3% of gold,” “this shift is “in ahead custty, the hardest assets that Bitcoin is known to humans.” The newly issued supply of miners has resulted in a rounding error compared to total demand. The dramatic, miner-led bust of the previous cycle becomes like artifacts from the previous era. “In short, the 80-90% drawdown behind the Bitcoin cycle has historically been dead.”

Edwards does not deny that cycles exist. He reconstructs their causes. Reflective investor behavior, macro liquidity, extreme range of chains, and “euphoria” in the derivatives market can generate substantial drawdowns. However, if half the calendar no longer directs these inflection points, investors will need to readjust the signals they monitor and the timelines they expect to crystallize the risk.

Related readings

Regarding reflexivity, he warns that four-year script beliefs in itself could become a price driver. “If enough bitcoiners believe in a four-year cycle… they will constitute the investment activity around it,” he points out, evoking George Soros’s notion that the market narrative returns to its foundations. That self-realization factor can cause “substantial drawdowns” even if miners are no longer marginal pricers.

In Edwards’ framework, macro fluidity remains critical. He tracks the “pure fluidity” gauge. This is the year-on-year growth of global money minus the cost of debt (in favor by US 10-year Treasury yields).

Historically, “All of the historic bear markets for Bitcoin have occurred. While this metric was decreasing…with depth…this metric was below zero,” he writes, but “all of the major Bitcoin bulls’ runs occurred in a positive net-life environment.” As of mid-August, he characterizes the condition as constructive. “We are currently in a positive liquidity environment and the Fed is projected to cut its fees three times for the remainder of 2025.”

On-chain data is still cooperative

If fluidity sets the tide, happiness marks bubbles. Edwards points to established on-chain gauges (MVRV, NVT, energy value) that are historically flashing red during cycle peaks. These indicators aren’t there yet, he says. “We still don’t see any signs of on-chain euphoria in 2025. Bitcoin today is grateful for its historic cycle and a relatively sustainable, stable, and relatively sustainable way.”

The MVRV Z-Score chart “inds that we are not approaching the euphoria of the historic Bitcoin top price.” In contrast, his derivative composite (“heaters” that aggregates the position and leverage of Perps, futures, and the overall options” has become so hot that it requires short-term attention. “Of all the metrics we see here, the heat is on. This shows that the market is overheating this week at close proximity to all times,” he says, and the overpass of heater measurements could rise above the nearest stage, unless it lasts for months, along with a growing number of open interest.

However, one metric covers the rest from 2025-26. Institutional absorption of new supply. “Today, more than 150 public companies and ETFs are purchasing more than 500% of the creation of daily supply from Bitcoin mining,” writes Edwards. “When demand is supplied in this way, Bitcoin has historically skyrocketed over the coming months. Every time this happens in Bitcoin’s history (five events), the price has risen on average by 135%.” He emphasizes that the current extended high multiple period of this measure is “good news for Bitcoin” and accepts clear warnings.

Related readings

Edwards details the “early warning system for finance companies” because systemic demand could be reversed to supply. He highlights four watch items that his team tracks “24/7 for cycle risk management and positioning purposes.” The Ministry of Finance’s CVD, which flattens or distorts into the “red zone,” is “risk-off.” The percentage of Coinbase volume that is purchased online. And the treasury company sellers think that with spikes it has historically preceded the pressure.

What’s stacked on top is a balance sheet vulnerability. The more Treasury Department has to accumulate Bitcoin, the more you can cascade the drawdown by forcing it to be released. “Total debt to enterprise value is key to tracking,” he said, adding that Capriol will publish a fresh tranche of financial risk “next week.”

Quantum Computer vs Bitcoin

Edwards argues that many Bitcoin investors find uncomfortable. Quantum computing is an attractive return opportunity and the risk of Bitcoin’s most specific long-term tail. Capriol said it expects “Asset class will be better than Bitcoin at 50% PA over the next five to ten years.”

At the same time, “In the long term (unchanged), QC exists for Bitcoin,” and the worst case window “3-6 years” breaks the encryption that secures wallets and transactions. He said China “expends more than five times more on QC than the US,” and recently “shows the QC machine a million times more powerful than Google.”

Even if risks aren’t imminent, operational challenges are the transition routes. Edwards sketches envelope constraints: approximately 25 million Bitcoin addresses hold over $100. On a “good day”, the network processes around 10 transactions per second. If everyone tries to rotate tolerance keys at once, and if many people send test transactions carefully, it takes “3-6 months” just to push the transaction. “I’m optimistically considering a 12-month lead time to move the Bitcoin network into a quantum proof system,” he writes. He flags the work by Jameson Ropp as a starting point, urging the community to “encourage action against the QC Bitcoin Improvement Proposal (BIP).” Capriol itself retains quantum computing exposures both in the potential for return and in “if the worst case scenario exists, if the portfolio hedge becomes an event.”

His conclusion is clear without being satisfied. “Bitcoin miner-driven cycles are largely dead.” If institutional demand is held, “there is a strong possibility of a correct translated cycle,” “there is still a significant price expansion ahead of us.” But vigilance is essential.

In his view, the two variables prioritizing this half-epoch are “net liquidity and facility purchase,” and “the greatest risk to this cycle” is paradoxically a cohort powered by it. Quantum computing emphasizes that “it’s not a risk of Bitcoin this half-cycle,” but there is no action that says, “it’s certainly going to be the next thing.” Prescriptions are not afraid of cycles, but rather to retire outdated cycles and prepare technically and operationally for the remaining cycles.

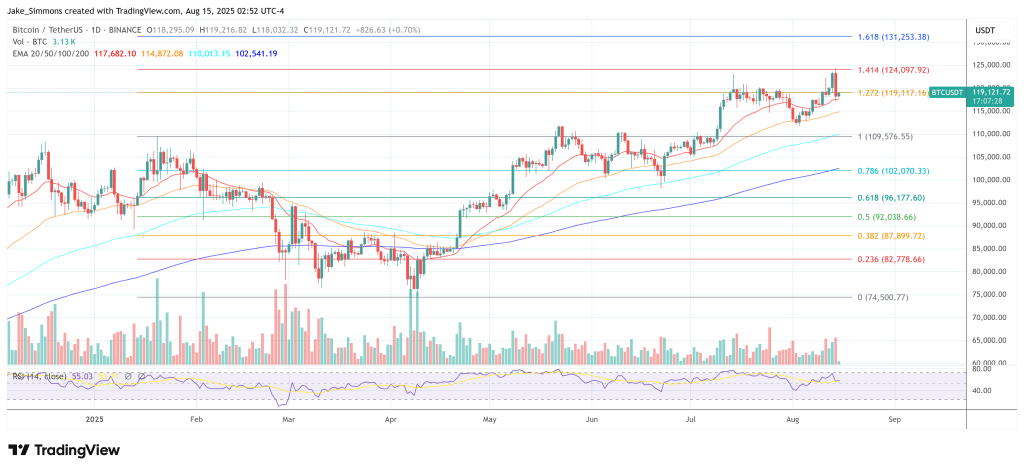

At the time of pressing, BTC traded for $119,121.

Featured images created with dall.e, charts on tradingview.com