Solana (Sol) is trying to regain a strong zone of resistance for the fourth time. This suggests that some investors will not last long. Nevertheless, on-chain data suggests that the next leg of Sol may be on-starting.

Related readings

Solana breaks out of the triangle pattern

On Thursday, Solana hit a six-month high of $216 after escaping from one of her most important zones of resistance. The cryptocurrency bounced back 16% from Monday’s low, regaining a $200 barrier in support on Wednesday, closing the region’s day.

Sol temporarily regained this level during a breakout in early August, but a recent market correction dragged the price into the $175-$195 area. During a rally on Thursday, market watcher Dern Crypto Trade highlighted its performance, claiming it was “in an interesting place.”

Traders explained that Solana is trading in a multi-month rising wedge pattern, approaching the resistance level that has been held for several months. In particular, cryptocurrencies have been rejected multiple times from the pattern cap since July, retesting their ascending support lines on each occasion.

In support of Sol’s case, Daan argued that “the back of the financial vehicle will be spun, and there is a strong possibility of future purchases + Trunning,” saying, “While rising wedges are generally bearish, in the Bull Market, it’s nothing new that these will be upside down instead.” Based on this and recent performance of cryptocurrency, he predicted it would reach higher levels later this year.

Similarly, analyst Ali Martinez pointed to a six-month upward triangle pattern on Altcoin’s chart, covering the $360 area. Solana has retested the pattern’s resistance three times over the past month and a half, but has ultimately failed to support the $205-$207 zone.

When Altcoin pushed past the $210 mark, analysts raised the question of whether an ongoing breakout attempt would be successful, or whether Sol’s rally would be short-lived for the fourth time.

Is the fourth one attractive?

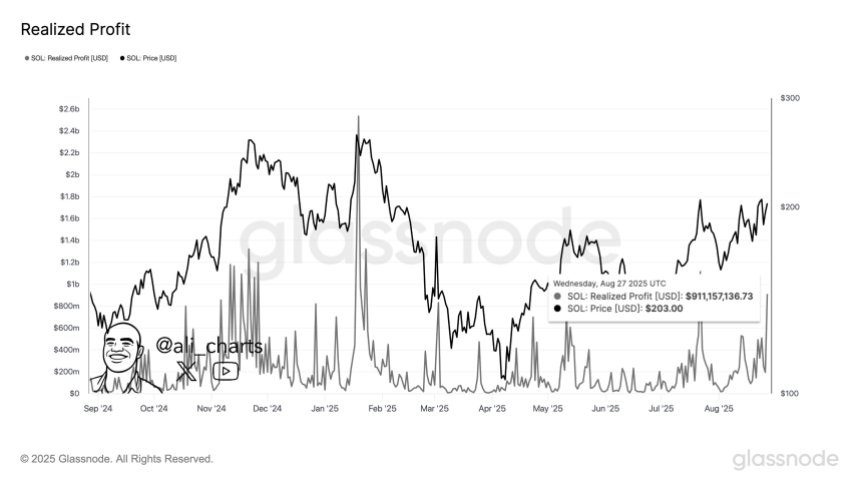

Martinez shared several technical metrics suggesting that Solana could eventually break out of this pattern and aim for the much-anticipated $300 barrier. Analysts explained that the background to social sentiment and on-chain positioning distinguishes current price movements from previous attempts.

Unlike previous breakout attempts, the overall community’s sentiment is more calm. “Historically, euphoric feelings above the ‘230’ index level coincided with local tops as excessive optimism precedes the setback,” he elaborated. This time, the emotions have been muted, suggesting “skepticism rather than crowded bullish positioning,” according to the analyst chart.

Additionally, it is being booked after a realised profit of around $1 billion has surged to $212, with some traders likely to retain momentum during this attempt.

He also highlights that there are substantial accumulation zones below $207 and multiple support zones between $165 and $206, providing a strong foundation for continuing the rally, in contrast to the lack of resistance beyond the $212 area.

Related readings

“When pressure builds up, the path to $300 is relatively unobstructed,” Martinez asserted, adding that Solana’s basics, including the proposed Alpenroe consensus upgrade, could also add fuel to the breakout.

“Scepticism still exists, strong accumulation below $207, and little resistance makes this attempt more likely to be successful compared to previous obstacles.

At the time of this writing, Solana is trading at $212, with a 17% increase in weekly time slots.

Unsplash.com featured images, tradingView.com charts