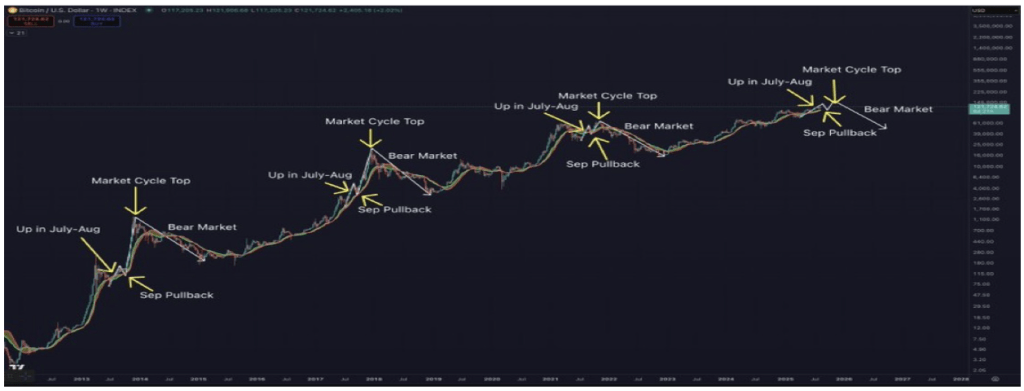

New technical analysis suggests that Bitcoin (BTC) and the broader crypto market could mirror Historical post-harning cycle patterns. The market has previously gathered by July and August, but historic fractals have shown potential crash drops in September, and will be afterwards. Cycle Peak The second half of the year.

Related readings

September proves dangerous for Bitcoin and the crypto market

Recent X Social Media post Crypto analyst Benjamin Cowen said Bitcoin price action That could have a great deal of significance for the market over the next few months. His analysis shows that Bitcoin consistently follows the post-harving cycle. Seasonal price movementsEspecially around July, August and September.

The charts shared by Cowen often occur in previous cycles by Bitcoin. Gathered in July And in August, it promotes optimism and strong market sentiment. However, each time this is followed by a September crashresets before the final push towards the top of the cycle. The last quarter of the year.

Analysis shows that this repetition structure is not inherent to a single cycle, but appears across multiple past cycles, giving weight to expert arguments that history can be repeated. In 2013, 2017, and 2021, Bitcoin price behavior followed this pattern roughly the same pattern, indicating the strength of its weaknesses in September.

Following each of these cycles after the final meeting to the peak Extended Bear Market Phaseduring which time, the rating was revised sharply from highs. Based on Cowen’s report, the current cycle appears to be unfolding in the same way. Bitcoin has already shown strength in July and August this year, and Spark Concerns The September pullback may be approaching.

The BTC cycle suggests there is still room for growth in the market

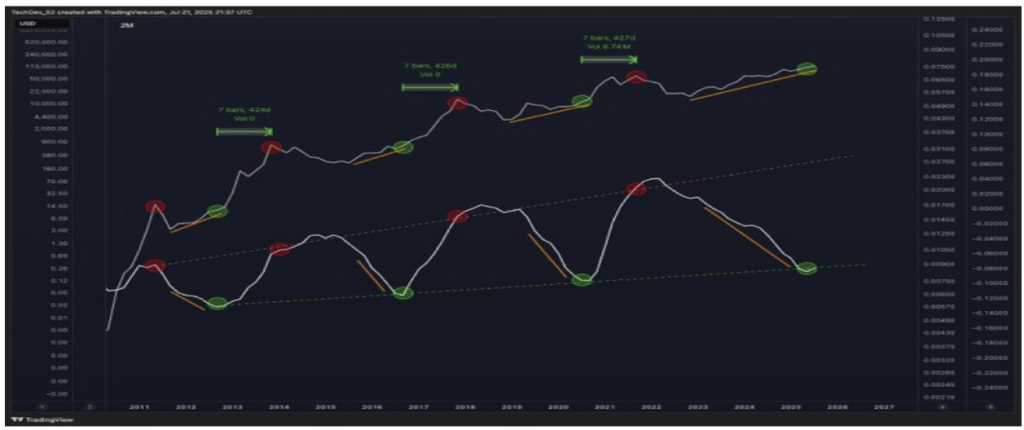

New technical analysis by crypto market expert TechDev clearly It is a recurring pattern of Bitcoin’s long-term price cycle, and contrary to popular belief, the current market is still It’s far from that peak. The analysis supported by the historic chart of BTC’s performance shows that all market tops consistently occurred around 14 months after a particular circulating signal.

The chart outlines multiple Bitcoin cycles dating back to 2011, with the tops and bottoms clearly marked with green and red indicators. Each upward run is followed by a significant revision followed by a recovery accumulation stage. Data also revealed that each cycle top is often aligned with a measured time frame of approximately 420 days.

Related readings

Based on this model, the current predictions show that Bitcoin still has room to run. The latest green markers on the chart indicate that the market may already be moving from the corrective stage. If historical patterns apply, this could mean that the market will enter a long-term growth window I’m getting closer to fatigue.

Unsplash featured images, TradingView charts