Bitcoin fell to a low level since July 8 after Wall Street opened on Friday, with prices sliding and traders scrambled to reevaluate their short-term plans.

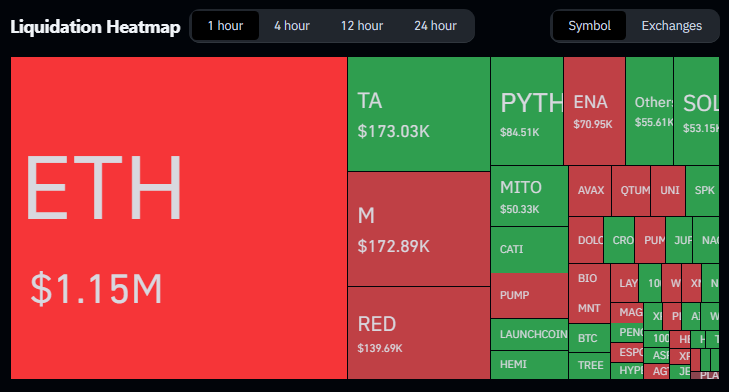

According to Coinglas, the 24-hour crypto liquidation approached $540 million as sales pressures increased on major exchanges.

Related readings

Whale and exchange distribution pressure

Based on reports from Market Watchers, large sales by large owners helped push the drop. The distribution into binance was highlighted by traders as an important factor that exacerbates losses.

Bitcoin lost nearly 5% that day, with some large accounts linked to a wave of sales that caused suspended orders and quick exits.

Popular trader Daan Crypto Trades pointed out a “key inversion zone” about recent ranges and integration levels.

Some experts pointed out that Bitcoin could not lead $112,000 to support, as he had a similar price level on his radar. Other voices in the market have flagged it at $114,000 as a weekly close threshold that is important for bulls.

Bullish RSI divergence keeps the desired sliver

The technical watcher found one bright spot. According to Crypto commentator Javon Marks, the four-hour chart shows bullish RSI differences. This is a pattern where RSIs take a higher lowest and prices go down. That setup could suggest an early reversal.

A good area to keep watching $ btc. It is above the previous range and consolidated area. https://t.co/weag2if6nv pic.twitter.com/y7rftsqdio

– Daan Crypto Trades (@daancrypto) August 29, 2025

Marks claimed that Bitcoin could stage rebounds. He suggested that a move to $123,000 was possible. This would be about 14% jump from the current level. That projection is optimistic and depends on the momentum quickly reversal in the buyer’s favor.

Macro data, seasonal weakness adds headwinds

Seasonality and macroeconomic data added pressure. September has historically been one of Bitcoin’s weaker months, with investors carefully looking at US inflation measurements.

The Federal Reserve’s preferred inflation measure, the Personal Consumption Expense Index, coinciding with expectations, showed signs of inflation rebound.

Still, CME Group’s FedWatch tool showed market pricing for interest rate reductions in September.

Related readings

For now, traders are monitoring between $112,000 and $114,000

Reports reveal that traders are focusing on narrow price markers. If Bitcoin can regain $112,000 and hold a weekly deadline of over $114,000, the Bulls will win a breathing room.

If these levels fail, there are more downsides possible, and short-term traders could face further liquidation.

For now, the market looks tight. Some technical signals show rebound, but macro data and big sellers are ready for the mood.

Traders and investors alike are looking closely at both price action and economic printing as the US heads towards key data and the Fed decision window on September 17th.

Unsplash featured images, TradingView charts