Miners are increasing relocating to Crypto Exchange as Bitcoin (BTC) continues hovering just below the $120,000 level. According to analysts, the rise in BTC transfers could indicate future price adjustments for the best cryptocurrency.

Will Bitcoin price adjustments be made in the future?

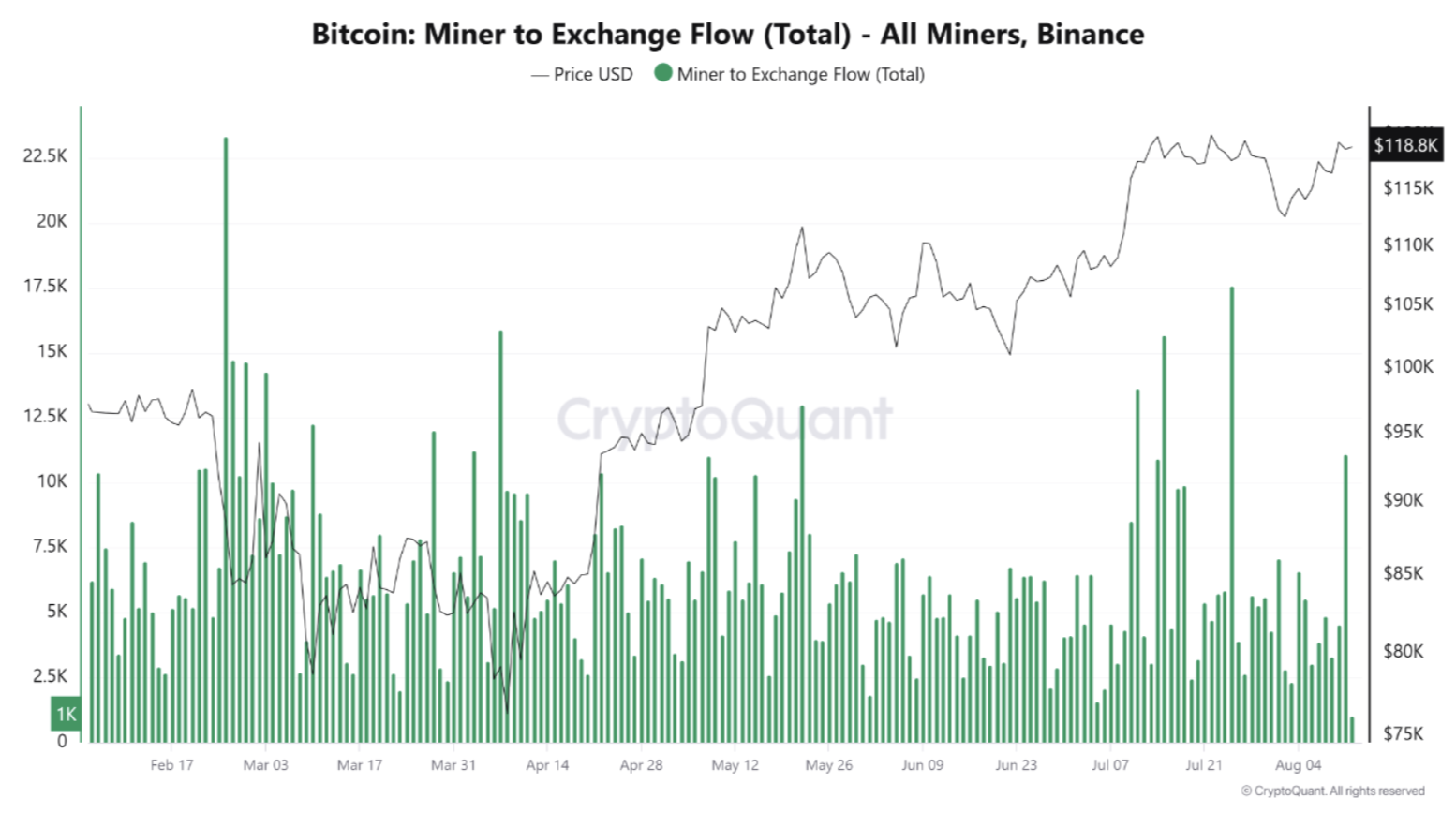

According to a cryptographic quick take post by the Arab chain of contributors, there was a huge surge in BTC transfers from miners to binan script exchanges in late July – shown in the form of double-top on the following chart.

These spikes were followed by several above average days to replace. In early August there were transfers ranging from thousands of BTC to over 10,000 BTC at peak times.

Related readings

This activity suggests that miners continue to distribute BTC in exchange. The sale will be made as the asset price remains close to its all-time high (ATH) of nearly $120,000.

The Arab chain noted that current miners’ activities are similar to “stockpiling or hedging behavior” rather than typical low-noise patterns, compared to the April-June period. Analysts shared several behavioural metrics to support this view.

For example, sustained high inflows during price levels suggest that miners use rallies to ensure liquidity, cover operational costs, or manage the Treasury needs after harving.

However, such large influxes are often associated with short-term resistance. The market must have sufficient purchase liquidity to absorb this supply and prevent it from causing a sudden price drop.

The frequency of peaks over the past two weeks indicates that this is not a one-off occurrence. Instead, it marks a stage in which activity has increased among vinance miners, increasing the sensitivity of the price to lower demand for Bitcoin.

According to Arab chains, supply pressures are ongoing if the recent weekly average of around 5,000-7,000 BTC per day is above the daily average. Conversely, rapid declines when returned to low levels suggest that the distributed waves are temporary and already absorbed.

BTC may be preparing for a new ATH

Recent on-chain data shows despite consolidating just under $120,000 Some signs Bitcoin market overheats. Additionally, the average executed order size in the Bitcoin futures market is steadily Reductionshowing an increase in retail participation in rallies.

Related readings

That said, a considerable portion of the short-term BTC holder has moved to Profityou can set the stage for sale. At the time of pressing, BTC will trade at $118,970, a 0.6% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts