Bitcoin (BTC) yesterday created a fresh all-time high (ATH) that reached $124,474 on Binance before stabilizing around $118,000 at the time of writing. Meanwhile, BTC has seen a massive surge in bookings for Vinance, raising concerns about potential price corrections.

Bitcoin reserves spikes in Binance: Time to worry?

Binance’s Bitcoin Reserve has risen sharply in recent months, according to a cryptographic Quicktake post by the Arab Chain. The exchange holds the largest BTC reserve, supported by high liquidity and the largest trading volume in the market.

Related readings

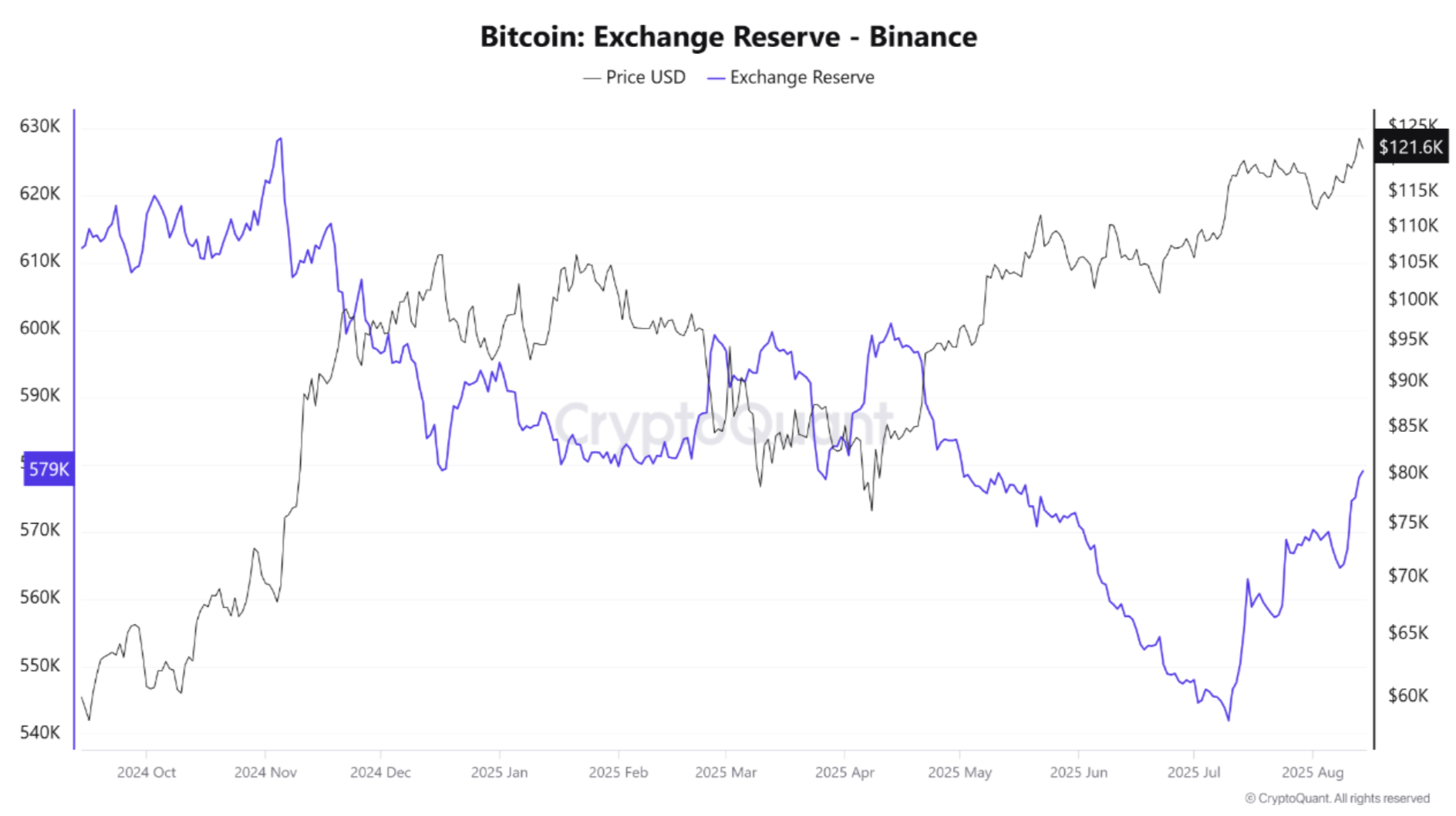

From the end of July until today, the Binance-based BTC reserve rose to 579,000 BTC, reversing the previous downward trend. The Arab chain shares the following chart showing how BTC reserves after a period of rarity, reverses the course and presents a short-term warning.

In particular, BTC’s BINANCE reserves previously had a decrease of approximately 50,000-60,000 BTC. This was down 10% from 9% to the lows between 2024 and July 2025. Reserves have recently been recovered slightly, increasing by 25,000 to 30,000 BTC, and up by 5% to 6%.

Despite this recovery, BTC reserves are well below the peak of late 2024, indicating that structural rarity has not yet completely resolved. Arab chains highlighted two potential reasons for the recent surge in reserves.

First, if traders, including whales and market makers, deposit BTC on exchanges, it could lead to increased profit acquisition or short-term supply. They can do this, selling some of their holdings and using digital assets as collateral for the derivatives market.

Second, an increase in BTC liquidity can occur when demand increases leads to replenishment of the liquidity pool. Market makers can also ease the balance of their portfolios and smooth out their price spreads. The analyst concluded:

In fact, if daily or weekly reserve increases persist along with high positive funding rates and rising open profits, the likelihood of short-term revisions increases. However, if reserves stabilize or decline rapidly, this suggests an updated rarity and a continuing uptrend.

Is the BTC Rally losing momentum?

BTC was pulled back from the recent ATH, trading just over $118,000 at the time of writing, signaling a short-term price adjustment. Some analysts caveat This could indicate that the flagship cryptocurrency is losing momentum.

Related readings

In addition to the rising exchange reserve, there is also the exchange flow metric from the Binan Skudhale. It’s increased Sales pressure. spike In Binance, minor distributions enhance this signal.

That said, some analysts remain cautiously optimistic. Axel Adler Note Due to BTC’s current market structure, serious price adjustments are unlikely. At press time, BTC will trade at $118,464, a 0.8% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts