Reports suggest that Qubic’s mining group selected Dogecoin as its next target after claiming it had temporarily acquired a majority control of Monero’s network.

Related readings

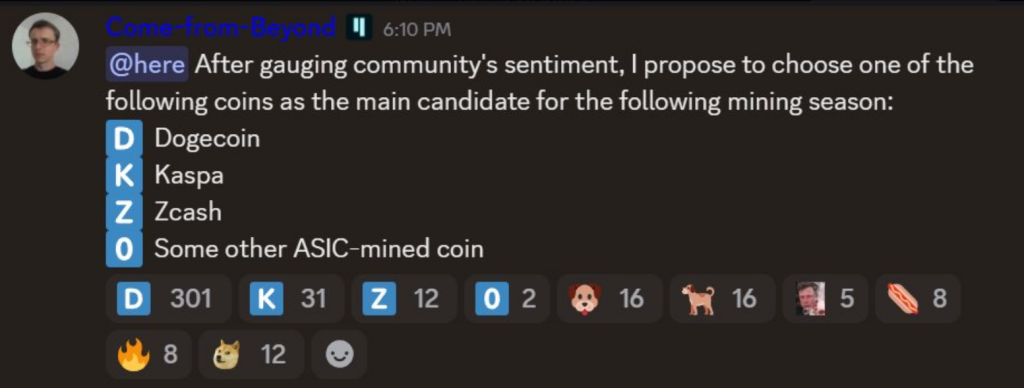

The group said they had reorganized the six blocks of Monero and asked the community to vote on which ASIC-friendly job proof coins to test next. The vote came on August 17th.

Community chooses dogecoin

Based on the report, Dogecoin won over 300 votes. Qubic founder Sergey Ivancheglo shared that Dogecoin defeated Zcash and Kaspa in a public investigation.

The project states that Monero pool has reached a 51% share and is currently running around 2 points 3 GH/s of Monero Hashrate.

The group calls these movements “stress tests” and intends to show how mining models work, while also using pool benefits to purchase and burn key tokens. The group added that they did not want to destroy the network.

The #Qubic community has chosen #DogeCoin. pic.twitter.com/enevizuaw5

– Beyond (@c___f___b) Beyond (@c___f___b) August 17, 2025

The technical claims sparked debate in the Monero community. Some developers and miners have questioned whether the pool has not been held to date.

Others say that the behavior is evidence that a group can change short stretches in their chain history is evidence of that behavior. In any case, the suspension was sufficient for Kraken to suspend Monero Deposits while the exchange and service assessed the risk.

Be able to attack 51%

A 51% attack allows the controller to reorganize the block or stop the transaction. Groups that control more than half of the network’s mining power can rewrite recent blocks, stop certain transactions, or try to spend twice as much.

Qubic’s move showed that it could force Monero to a small Reorg. If DogeCoin is applied with a similar level of control, it could be more effective as Dogecoin’s market capitalization exceeds $35 billion.

Still, Dogecoin benefits from mining that merged with Litecoin and runs at a much higher hashrate, so attacks can be much more costly.

The exchange with the market responded quickly. Prices have moved on news, and storage services have strengthened checks.

Kraken’s decision to suspend sediment highlighted how the exchange acts swiftly when the block resumes or other threats appear. Users and traders faced an increase in short-term uncertainty.

Related readings

What to see next

Based on the report, the timeline is unknown, but the issue raises a greater question. Qubic doesn’t give you a clear timeline of actions against Dogecoin.

Observers monitor technical logs, more statements from the project, and answers from Dogecoin and Litecoin developers.

Hostile act?

People are also looking for evidence that the Qubic test is non-destructive and how long the pool actually holds control.

Most outlets call Qubic doing 51% attacks (chain Reorg) in the usual sense rather than “hack,” but it is still an attack on the consensus of the network, and many people treat it as hostile.

Meta featured images, TradingView chart