Bitcoin is It was adopted as part of Their financial strategy, but the gap between digital assets and these companies is becoming more pronounced.

Over the past 10 weeks, stocks in Bitcoin Finance Company (BTCTC) have fallen sharply, dropping from 50% to 80% of its value. This divergence shows an abnormal pattern, effectively creating a “1:4 ratio” for cycle behavior.

Related readings

12 mini bear markets in 18 months

Bitcoin price action over the last 18 months has been mostly in the bullish cycle of the macro end, along with major cryptocurrencies Create a new price high New prices highs within this period. This has led to a large number of people increasing Companies adopting Bitcoin financial strategies A balance book also known as Bitcoin Treasury Companies (BTCTCS).

However, according to To data from Crypto commentator Mark Moss, a stock price for companies with a Bitcoin strategy, branches out from Bitcoin and has cut stock prices by 50% to 80% over the past 10 weeks. Moss said the divergence shows a rare 1:4 cycle ratio in which corporate Bitcoin holders receive four mini-cycles per Bitcoin market cycle.

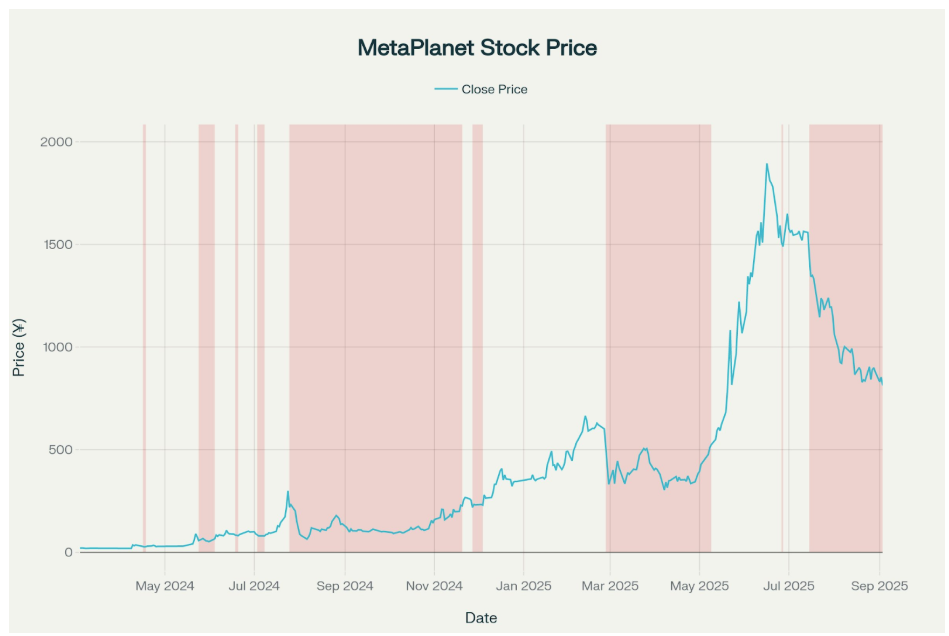

Japanese company Metaplanet This is the main case study of this occurrence. Over the past 18 months, the stock ($MTPLF) has experienced 12 different drawdowns, ranging from a sharp day entry to a long-term decline that has grown over several months. On average, these slumps erased 32.4% of the value and lasted about 20 days. The quickest fix was a cruel one-day slide of 22.2% in April 2024, while the longest and deepest crash lasted 119 days from July to November 2024, wiping out 78.6%.

The chart below of Metaplanet stock shows repeated sell-off cycles that appear to be far more compressed than Bitcoin price adjustments over the past 18 months or so and seemingly extreme.

Metaplanet Stock Price: Mark Moss of x

Correlation with Bitcoin?

Interestingly, only 41.7% of Metaplanet’s drawdowns line up directly with Bitcoin fixes. Of the 12 identified mini-bear markets, only five occurred in sync with the decline in BTC. The majority (7 out of 12) were unrelated to Bitcoin and instead were caused by company-specific factors. According to Moss, these factors include warrant practice, fundraising activities and the compression of Bitcoin premiums that Metaplanet trades compared to BTC holdings.

However, the two most severe drawdowns overlapped with Bitcoin volatility. The -78.6% collapse and -54.4% drawdown in the second half of 2024 coincided with the period when Bitcoin itself was revised. These overlapping events suggest volatility in BTC It may be added to the drawdown, Metaplanet’s stock sales tend to expand beyond the Bitcoin slump.

Essentially, what this means is that instead of a 4-year BTC cycle, BTCTC is similar to four-cycles in a year.

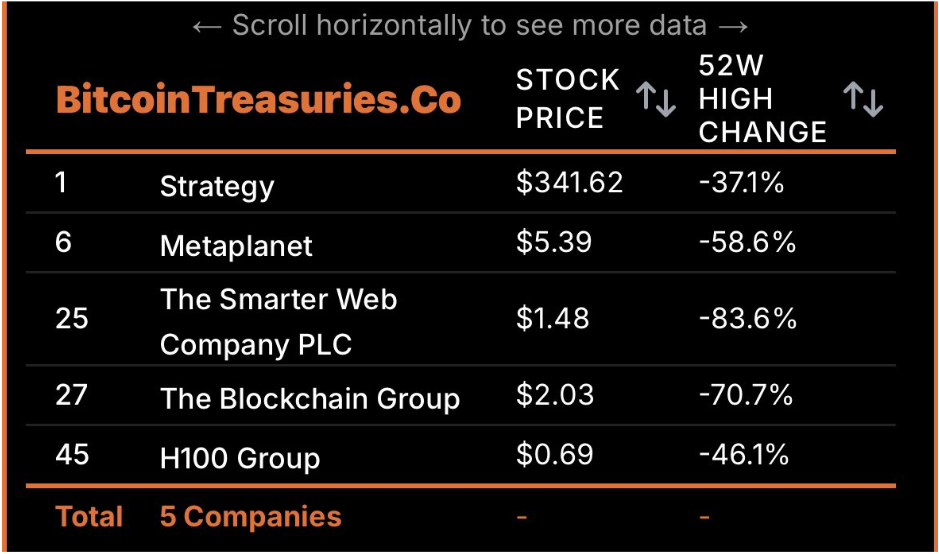

At the time of writing, Bitcoin is in the correction stage And they struggle to surpass the $110,000 support level. Popular BTCTC stocks struggle with downtrend along with Bitcoin. Strategic inventory is declining Metaplanet has declined by 37.1% from the 52-week height, and 58.6%. Others like Smarter Web Company PLC (-83.6%) and Blockchain Group (-70.7%) are exposed to great losses.

BTCTC Stock Price: Bitcointreasuries

Related readings

Unsplash featured images, TradingView charts